On the lack of association between taxes, GDP and happiness

During a February 6, 2016 debate, U.S. presidential aspirant Donald Trump claimed that: “Right now we’re the highest taxed country in the world.”

Well, living in a country with much higher tax rates, I can tell you that his statement is patently false.^[Maybe he’s referring to the corporate tax rate which is quite high; but even that is irrelevant to the fact that all sorts of deductions and exclusions on the U.S. corporate tax return put the U.S. effective tax rate much lower than that of most counties.]

But, really, who cares? That’s not just a snarky dismissal either. Who are the people most interested in low marginal tax rates? In Latin, they would say “cui bono?” - to whose benefit? When governments raise taxes, most of the increase is on the upper brackets. That’s who cares.

The most common way of comparing tax rates worldwide is to look at tax revenue as a percentage of the gross domestic product (% GDP.) In the U.S. taxes accounted for 26% of the GDP, placing the U.S. 27th out of 30 countries in the OECD. The U.S. is not the most heavily taxed country. But, still who cares?

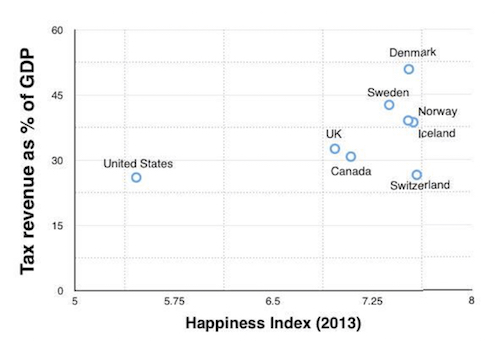

What we should care about is that the relationship between tax revenue as a percentage of GDP and the country’s happiness index is a scatter plot. The U.S. is unique in having a fairly low % tax revenue and a very low happiness measurement.

Among countries with higher happiness indices, there’s no relationship between tax revenue as a percentage of GDP and happiness. It’s not tax revenue that you should care about, it’s about how happy you are in your daily life. You know the old adage about how “Money can’t buy you happiness.”? The U.S. is an example of why high residual personal income after taxes (because of the relatively low % taxation) has nothing to do with happiness.

In some surveys, Danish citizens are among the happiest in the world, yet their marginal tax rates are also among the highest. I’d rather be happy than extremely wealthy any day.